Whatever your circumstances, it is important to take a hold of your finances and ensure that you are in the best position to move forward towards a future that gives you the comfort that your household outgoings are going to be met and that you will have some money in your wallet or purse to have a life too! If you would like to try and break free from the shackles of debt by looking at a debt consolidation loan you could start by calling us on our mobile friendly number 0333 003 1505 or our free phone number on 0800 298 3000 to speak to our understanding finance team - alternatively fill in ouron line enquiry form, don’t worry - no credit search will be carried out from this form.

Should I Take Out A Debt Consolidation Secured Or Unsecured Loan?

If you are a homeowner or a tenant you can look at personal unsecured loans to try and refinance your debt or perhaps consider a Guarantor Loan.Personal loan plans via ourselves go up to advances of £15,000. Guarantor loans require another person (friend, colleague or relative) to make the payments if you cannot. These are available up to a maximum of £12,000. If you are a homeowner but cannot raise enough money or spread the payments over a long enough term this way then you may find more flexibility with a secured personal loan, this can also apply if you have some bad credit or are self employed and find you cannot get an unsecured loan. Whatever option you choose to help your debt problem it is important to weigh up the pro`s and con`s:Advantages

- You might be able to secure your debts on a lower rate loan than you are currently paying; especially if many of your debts are with outstanding credit cards, this can often reduce the total amount you would have had to pay and should reduce your monthly payments. If you cannot get a lower rate then you can look at extending the term of the debt to get the payments down, but this will increase the interest you pay back.

- You will only have to make two credit monthly payments each month, your mortgage and your secured loan. This can remove the stress of having to pay numerous people each month on different dates and allow you plan ahead and to concentrate on more important things.

- By decreasing the amount of debts you have to pay each month, it should make it easier to ensure you are making the few payments you do have, in full and on time and help to improve your credit score.

- When the term of your loan is finished, provided you have made all of your payments, you can be safe in the knowledge that all of the debt you consolidated will have been paid off in full, which clears your credit record and will improve your credit rating.

Disadvantages

Disadvantages- If you extend the term longer than the term of your existing debts you may incur extra interest, sometimes this could be many thousands of pounds depending on how long you spread them over.

- You are moving unsecured debt to a secured debt. Whilst unsecured lenders can seek their money back via the courts and cause a ccj and potentially force you to sell assets to pay them back, such as your home, a secured loan lender has the right to take possession of you fail to meet your commitments to them so you must THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME

- As it is a legal agreement you will have to pay a specified amount each month, if you do not make these payments it can negatively affect your credit score, this could cause you problems with raising finance in the future.

- As the loan is secured against your property YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

Is A Debt Management Plan Right For Me?

Maybe you cannot get any sort of loan or a remortgage and are still in an untenable position where your credit bills every month cannot be met with your income. Except where you can get family help or a higher paid job you may need to consider another debt solution, so read on for some benefits and drawbacks of debt management plans.Advantages

- You will only have to make one payment each month.

- You will no longer have to contact your creditors, as your debt management company will do that for you.

- You will be able to reduce your payments to a level that you feel you will be able to afford.

- You will be making some payment back to the companies who lent you the money in the first place, but it will be below the amount you agreed to day one

- Depending on the size and number of your debts it could take many years for them to be repaid, certainly longer than the original period as you are paying them less and they will probably have added late payment charges to your balance already.

- The fee`s that the debt management charge are taken out of your monthly payment before the rest is passed on to the creditors, this could be up to half of your payment and it will further extend the time it takes you to repay them even further.

- It is often the case that your creditors will default all of your accounts when you enter into a debt management plan, this will be recorded on and can severely affect your credit file and is likely to cause you problems if you try to raise any finance or a mortgage / remortgage in the future.

- As a debt management plan is an informal agreement it is not legally binding which means your creditors are free to take whatever legal proceedings they wish, at any time, even if you are still paying your debt management plan. Debt management plans vs Debt consolidation loans can pose many questions and deciding which is right for you is vital to ensure that you are making the correct steps to right your finances. We have given you an idea of the benefits and drawbacks of both secured loans and debt management plans, if you would like to discuss the loan options further and see if we can help you with your debt problems contact our office on 0333 003 1505 (mobile friendly) 0800 298 3000 (landline).

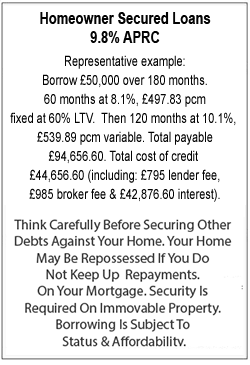

Homeowner Secured Loans Explained

With a homeowner secured loan you are putting all of your debts (excluding your mortgage) into one loan to clear all of your existing debts. This gives you one manageable payment each month and often can save you money if you can secure the debts on a rate lower than the existing ones you are paying off. The loan sits behind your mortgage effectively as a second mortgage. You pay the loan back in capital and interest payments monthly until the loan is paid back in full.Debt Management Plans, The Basics

Put simply, a debt management plan is an agreement with your creditors to repay your existing debt in instalments and is normally considered an informal arrangement. If you take out a debt management plan with a debt management company, they normally organise this on your behalf and charge you an ongoing monthly fee for doing this. Bear in mind you can effectively do this yourself by going to your creditors direct, write out a list and call them all to see how they can help. Alternatively you could contact the citizens advice bureau to try and help you get back on track. In most cases a debt management plan has no fixed lifespan; it depends on how much you owe and how much you can afford to pay. This means that you could be paying off your debt for a very long period of time to try and get debt free. As with most things it is a case of seeing what options you have and then sticking to your plan, doing something though is generally going to be better than doing nothing at all.What Is Debt Consolidation?

Debt consolidation can prove to be a positive way to alleviate your financial cash flow problems, but some people may not be able to take advantage because they don`t know what the process entails, so what is debt consolidation?

Simply put, it`s taking out a loan large enough to pay off your smaller, unsecured debts – things like credit cards, store cards, personal loans and even finance packages on cars or furniture. As they are larger and can be made more manageable by spreading the repayments they are quite often carried out via a refinance remortgage or a homeowner secured loan.

With the debt consolidation loan in place you will no longer pay the other credit items you have cleared as you`ll only have a single loan repayment to make each month, It should also mean that your monthly payments will be reduced, leaving you with a bit of extra cash in your pocket each month.

That`s because by consolidating your debts you will normally pay back the money over a longer period, although be advised that this can result in more interest being payable over the lifetime of the loan, so it is a case of striking the right balance to make sure the loan is affordable but you are paying it back as quickly as is practical.

So that`s what debt consolidation is, but how can you go about getting on top of your debts? One option to try is First Choice Finance , as a loan and mortgage broker we can search multiple plans for you from our panel of products, give you a free quote and offer it to you on a no-obligation basis.

When you are ready to refinance head to firstchoicefinance.co.uk or call us on 0333 003 1505 from a mobile or 0800 298 3000 from a landline.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential